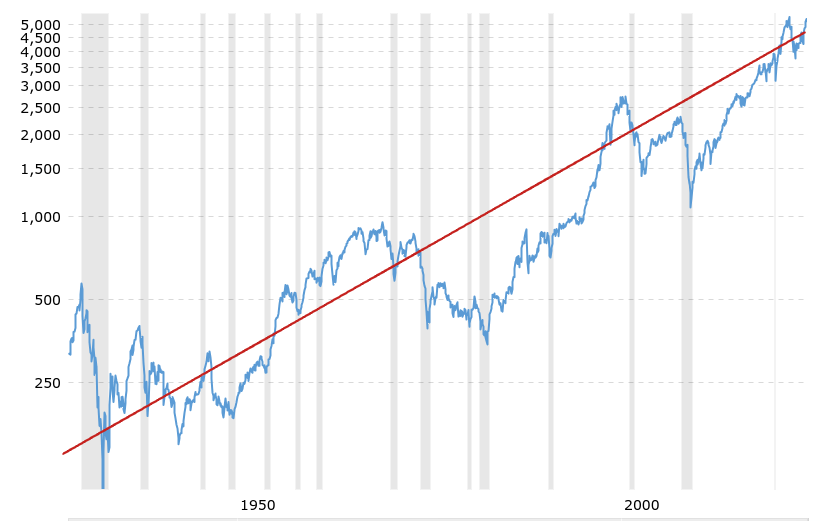

The U.S. economy is doing better than you think; Like everything in life, it goes in cycles.

In 1929 the stock market crashed ~90%

In 1973 the stock market crashed ~50%

In 1987 the stock market crashed ~35%

In 2008 the stock market crashed ~55%

In 2020 the stock market crashed ~35%

And recovered to all-time highs each and every time.

The stock market often reflects investor sentiment, meaning how ‘confident’ people are in their countries economy – sometimes people are excited – other years people are fearful. But that just means you have to wait out those that are fearful.

…Since 1926, the stock market has returned an average ~10.5% per year. Some years more, some years less. But let this post teach you one thing:

Never let short-term fear control long-term decisions

If you found this long-form post interesting, please subscribe to Military.Cash – I’m going to be continuing to post for years to come 🙂

As always,

-Michael, with Military.Cash – Follow me on Instagram with the icon below.

Leave a comment