If you’re in the military, and you don’t use credit cards to pay for your routine spending, you’re missing out. Here’s why:

1. You will earn $1,000’s a year in cash back: In 2023, I earned over $4,000 in cash back for buying groceries, dinners, gasoline, car insurance, and more.

2. You can travel for free! Every year I’m paid $300+ just to travel. From direct payments for plane tickets I buy and get reimbursed, to free seat upgrades on flights and reimbursements for rental cars, there’s plenty of ways to travel for free or at least a steep discount.

3. You get exclusive access to lounge (such as the Centurion Lounge) when you travel. What is the Centurion Lounge you ask? It’s one of the worlds best lounge programs offered by American Express. Especially if you TDY a lot, because it provides you free food, free alcohol and a place to nap on long travel days. You can even rent a shower or get a complimentary massage depending on which lounge you go to. Again, 100% for free.

But the perks don’t stop there. Here are more reasons why credit cards are a must-have:

4. Build your credit score effortlessly: Responsible use of credit cards can boost your credit score, opening doors to better loan rates and financial opportunities in the future. Meaning, if you just use credit cards for routine expenses (food, shelter, water, childcare, insurance), your credit score will increase with no downsides.

5. Enhanced security: Credit cards offer better fraud protection compared to debit cards. If unauthorized charges occur, you’re not liable for the money spent, providing peace of mind and security for your purchases. Credit companies will work much harder to get their money back from fraudsters compared to a bank – if your debit card gets compromised, it’s YOUR money that is at risk, not the banks.

6. Convenient budgeting and tracking: With detailed monthly statements and online account access, tracking your spending becomes a breeze. This helps in budgeting effectively and managing your finances with ease. For example, Chase (JP Morgan) offers a detailed spending chart at the end of EVERY month.

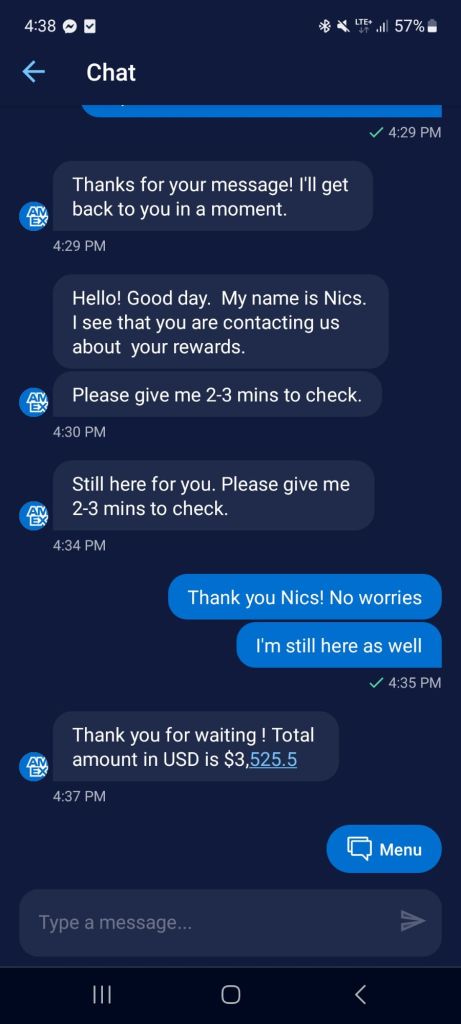

7. Purchase protection: Many credit cards offer purchase protection, extending warranties, and even providing coverage for damaged or stolen items purchased with the card. For example: I purchased a battery charger for my power tools that broke 6 months into ownership. I used AMEX’s chat function to get reimbursed so that I could purchase another charger. Simple as that.

8. Introductory bonuses: Many credit card issuers offer generous sign-up bonuses, providing lucrative incentives for new cardholders. These bonuses can range from cash rewards to travel miles, further maximizing the benefits of using credit cards for routine spending. That’s the reason I have 16 different credit cards – companies keep offering me welcome bonuses just for opening cards and spending like I normally would (again, all my cost of living expenses go on my credit cards… No excessive spending necessary).

The best part is, as a Active duty military member, both Chase and American Express waive the Annual Fees for opening their cards! (Saving you over $695 a year). You get all of the benefits of a cool titanium card, the travel benefits, the purchase protection, for completely free. It doesn’t get much better than that.

Ready to maximize your financial benefits? Sign up for the American Express Platinum & Gold cards with my referral link: https://americanexpress.com/en-us/referral/MICHAHA7YH?XL=MNTNS

Have an amazing day, and I’ll catch you in the next post.

-Michael, with military.cash

If you liked this content, feel free to give me a follow over on Instagram @ Military.cash

Leave a reply to What is Credit? And Why it Matters! – Military.Cash Cancel reply